Please refer to important disclosures at the end of this report

1

Incorporated in 2006,

Future Supply Chain Solutions Ltd (FSCSL) is one of the

largest third-party logistics service providers in India. FSCSL offers

services in three

key areas i.e. (1) Contract Logistics (warehousing, distribution and value-

added

service), (2) Express Logistics (point-to-point, less-than truck-

load, time definite

transportation services), and (3) Temperature Controlled Logistics (cold-

chain

warehousing, transportation solutions and distribution of perishable products).

Positives: (a) Diverse customer base across sectors

like retail, fashion & apparel,

automotive & engineering, food & beverage, FMCG, e-

commerce, healthcare,

electronics & technology, home & furniture and ATMs; (b) Improvement in

operational efficiencies, technological implementation and process enhancements;

(c) Asset-light model leading to higher operating leverage; and (d)

Experienced

management with logistics and retail sector specific knowledge.

Investment concerns: (a) For 1HFY2018, FSCSL reported revenue of `408cr

, out of

which 70% was from Future Group; (b) The company’s external business repor

ted

~2% negative CAGR over FY2015-17.

Outlook & Valuation: In terms of valuations, the pre-

issue P/E works out to 39.9x its

1HFY2018 annualized earnings (at the upper end of the issue price band), which is

lower compared to its peers like Mahindra Logistics. However, Mahindra Logistics

has lower promoter group business (internal business), which is ~54% v/s.

~70%

of FSCSL. Further, Mahindra Logistics had reported non-

promoter revenue CAGR

of ~46% v/s. de-growth of FSCSL over FY15-17.

Despite the above favorable

factors and lower valuations compared to Mahindra

Logistics, we however, believe that all the positives are fully factored in the

company’s current valuations, which does not provide any

further upside for

investors. Hence, we recommend Neutral rating on the issue.

Key Financials

Y/E March (` cr)

FY2015

FY2016

FY2017 1HFY18

Net Sales

408

520

561 357

% chg

-

27.4

7.9 -

Net Profit

25

29

46 33

% chg

-

18.6

55.5 -

OPM (%)

15.6

13.5

13.2 15.7

EPS (Rs)

6.2

7.3

11.4 8.3

P/E (x)

107.2

90.4

58.1 -

P/BV (x)

1.2

1.1

0.9 -

RoE (%)

11.4

11.9

15.6 -

RoCE (%)

15.7

15.0

14.8 -

EV/Sales (x)

0.8

0.7

0.5 -

EV/EBITDA (x)

5.1

4.9

4.0 -

Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end

of the price band

NEUTRAL

Issue Open: Dec 6, 2017

Issue Close: Dec 8, 2017

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 52.5%

Others 47.5%

Fresh issue: Nil

Issue Details

Face Value:

`10

Present Eq. Paid up Capital:

`40.1

cr

Offer for Sale: 0.98cr Shares

Post Issue Shareholding Pattern

Post Eq. Paid up Capital:

`40.1

cr

Issue size (amount): *

`646

cr -**650cr

Price Band:

`660

-664

Lot Size: 22 shares and in multiple

thereafter

Post-issue implied mkt. cap: *

`2,644

cr

- **

`2,660

cr

Promoters holding Pre-Issue: 57.4%

Promoters holding Post-Issue: 52.5%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Amarjeet S Maurya

+022 39357600, Extn: 6831

amarjeet.maurya@angelbroking.com

Future Supply Chain Solutions Ltd

IPO Note | Financials

Dec 04, 2017

Future Supply Chain Solutions Limited | IPO Note

Dec 04, 2017

2

Company background

Incorporated in 2006, Future Supply Chain Solutions Ltd (FSCSL) is one of the

largest third-party logistics service providers in India. The company’s services

include automated and IT-enabled warehousing, distribution and other logistic

solutions.

They offer contract logistics like warehousing and distribution services as well as

other value-added services including kitting and bundling, unit cartonisation and

packaging solutions, express logistics such as point-to-point, less-than truck-load &

time-definite transportation services and temperature-controlled logistics

comprising of cold-chain warehousing, transportation solutions, and long-haul

distribution services for perishable products.

They serve customers in various sectors including retail, fashion & apparel,

automotive & engineering, food & beverages, fast-moving consumer goods, e-

commerce, healthcare, electronics & technology, home & furniture and ATMs.

Issue details

FSCSL is raising `646-650cr through offer for sale of equity shares in the price

band of `660-664. Public offer of up to 9,784,570 equity shares of face value `10

each through an offer for sale of up to 7,827,656 equity shares by Griffin Partners

Limited and up to 1,956,914 equity shares by Future Enterprises Limited (Promoter

Selling Shareholder).

Exhibit 1: Pre and Post-IPO shareholding pattern

No of shares (Pre-

issue)

%

No of shares (Post-

issue)

%

Promoters 22,972,831 57.4% 21,015,917 52.5%

Others

17,083,407

42.6%

19,040,321 47.5%

40,056,238 100.0% 40,056,238 100.0%

Source: Source: RHP, Note: Calculated on upper price band

Objects of the offer

The objects of the Offer for the Company are to:

Achieve the benefits of listing the equity shares on the Stock Exchanges

Sale of equity shares by the selling shareholders

Enhance stability and brand image and provide liquidity to its existing

shareholders

Future Supply Chain Solutions Limited | IPO Note

Dec 04, 2017

3

Investment Rationale

Diverse customer base across sectors

FSCSL serves diverse sectors like retail, fashion & apparel, automotive &

engineering, food & beverages, FMCG, e-commerce, healthcare, electronics &

technology, home & furniture and ATMs. FSCSL has a diversified customer base in

each of the sectors it serves, including Indian corporate groups and multinational

companies apart from the Promoter and certain Group Companies.

Exhibit 2: Revenue break-up in Fiscal 2017

Sector Percentage of revenue from operations (%)

Fashion & Apparel 23.6

Automotive & Engineering 22.3

Food & Beverage 15.3

FMCG 7.3

E-Commerce 6.7

Healthcare 6.1

Electronics & Technology 6.0

Home & Furniture 5.6

ATMs 4.3

Others 2.7

Total 100

Source: Company, Angel Research

Longstanding relationship with Future Group Entities

The Future Group Entities are key customers of FSCSL and provide significant scale

in operations. The scale of logistics services for the Future Group Entities enables

FSCSL to capture economies of scale and drives automation and standardization

of processes to optimize the service offerings, thereby, further strengthening the

company’s relationship with these entities.

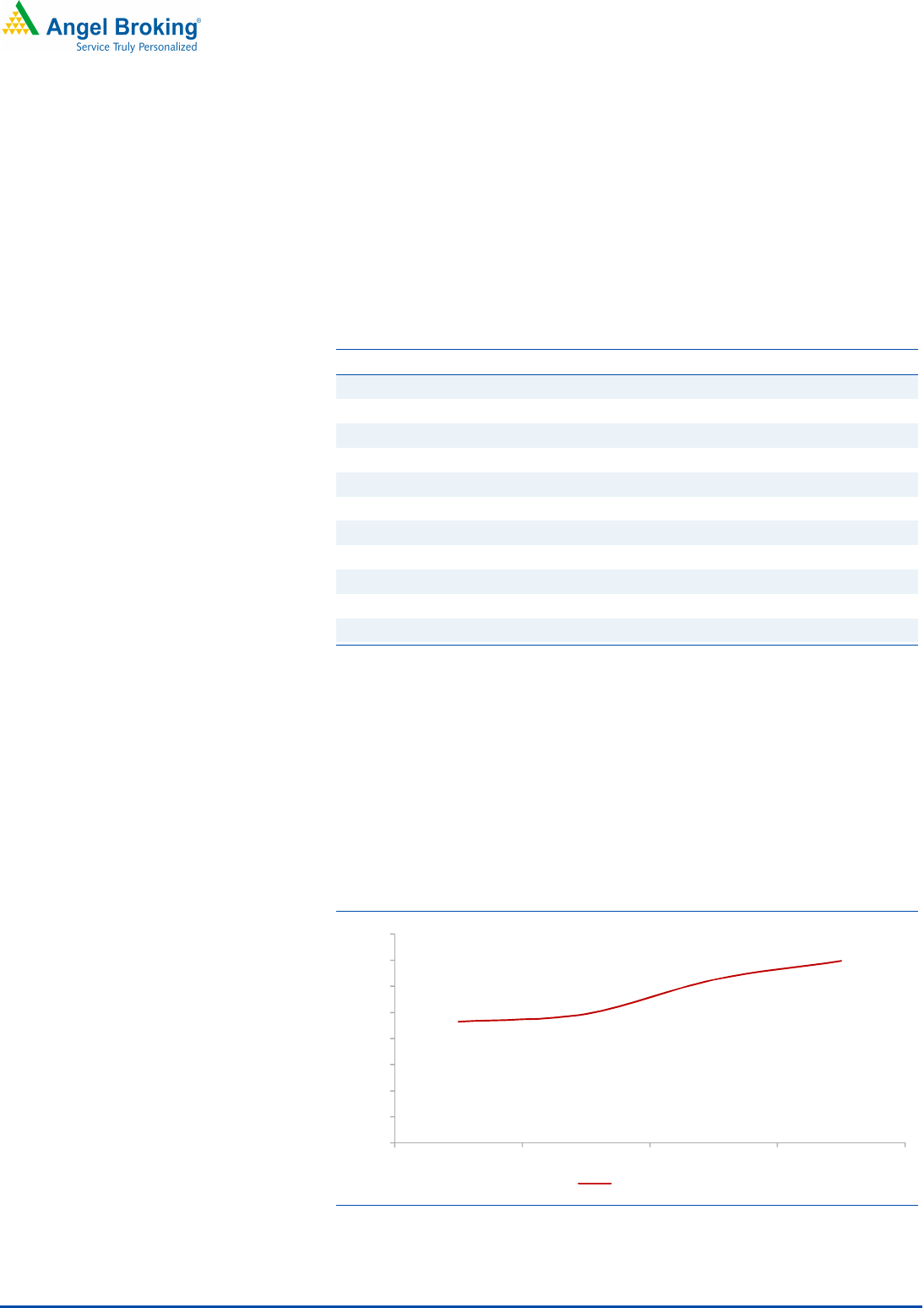

Exhibit 3: Revenue contribution by Promoter & Group Companies

Source: Company, Angel Research

0%

10%

20%

30%

40%

50%

60%

70%

80%

FY2015

FY2016

FY2017

1HFY18

% of total sales

Future Supply Chain Solutions Limited | IPO Note

Dec 04, 2017

4

Experienced management with logistics and retail sector specific knowledge

The management team of FSCSL is experienced in the Indian logistics and retail

industry. The quality of the company’s management team has been critical in

achieving business results. All members of the senior management have

substantial experience. The company’s chairman, Rakesh Biyani, has over 25 years

of experience in the retail, fashion, supply chain and logistics sectors. Further,

Managing Director and Chief Executive Officer, Mayur Toshniwal, has around 25

years of experience in the fast moving consumer goods and retail sector.

Experience in these industries is the key to drive business growth and provides

thought leadership in the supply chain space on making operations more efficient

and productive, including the use of technology.

Future Supply Chain Solutions Limited | IPO Note

Dec 04, 2017

5

Outlook and Valuation

In terms of valuations, the pre-issue P/E works out to 39.9x its 1HFY2018

annualized earnings (at the upper end of the issue price band), which is lower

compared to its peers like Mahindra Logistics. However, Mahindra Logistics has

lower promoter group business (internal business), which is ~54% v/s. ~70% of

FSCSL. Further, Mahindra Logistics had reported non-promoter revenue CAGR of

~46% v/s. de-growth of FSCSL over FY15-17.

Despite the above favorable factors and lower valuations compared to Mahindra

Logistics, we however, believe that all the positives are fully factored in the

company’s current valuations, which does not provide any further upside for

investors. Hence, we recommend Neutral rating on the issue.

Key Risks

Slowdown in the parent’s business and overall economy could impact the

company’s earnings

Consolidation by mid-sized players in the sector

Future Supply Chain Solutions Limited | IPO Note

Dec 04, 2017

6

Income Statement

Y/E March (` cr) FY2015 FY2016

FY2017

1HFY18

Total operating income 408 520

561

357

% chg -

27.4

7.9

-

Total Expenditure

344

450

487

301

Personnel 44 54

57

33

Others Expenses 300 396

430

268

EBITDA

64

70

74

56

% chg -

9.9

6.2

-

(% of Net Sales)

15.6

13.5

13.2

15.7

Depreciation& Amortization 20 21

19

10

EBIT

44

49

55

46

% chg -

11.6

11.9

-

(% of Net Sales)

10.8

9.5

9.8

12.9

Interest & other Charges 10 13

13

4

Other Income 3 9

16

8

(% of PBT)

7.5

19.3

27.2

15.8

Share in profit of Associates - -

-

-

Recurring PBT

37

45

58

49

% chg -

22.0

30.5

-

Tax 12 15

12

16

(% of PBT)

32.6

34.0

21.4

32.6

PAT (reported)

25

29

46

33

Extraordinary Items (0) -

-

-

ADJ. PAT

25

29

46

33

% chg -

18.6

55.5

-

(% of Net Sales)

6.1

5.7

8.2

9.3

Basic EPS (Rs)

6.2

7.3

11.4

8.3

Fully Diluted EPS (Rs)

6.2

7.3

11.4

8.3

% chg -

18.6

55.5

-

Source: RHP, SH - Share Holder

Future Supply Chain Solutions Limited | IPO Note

Dec 04, 2017

7

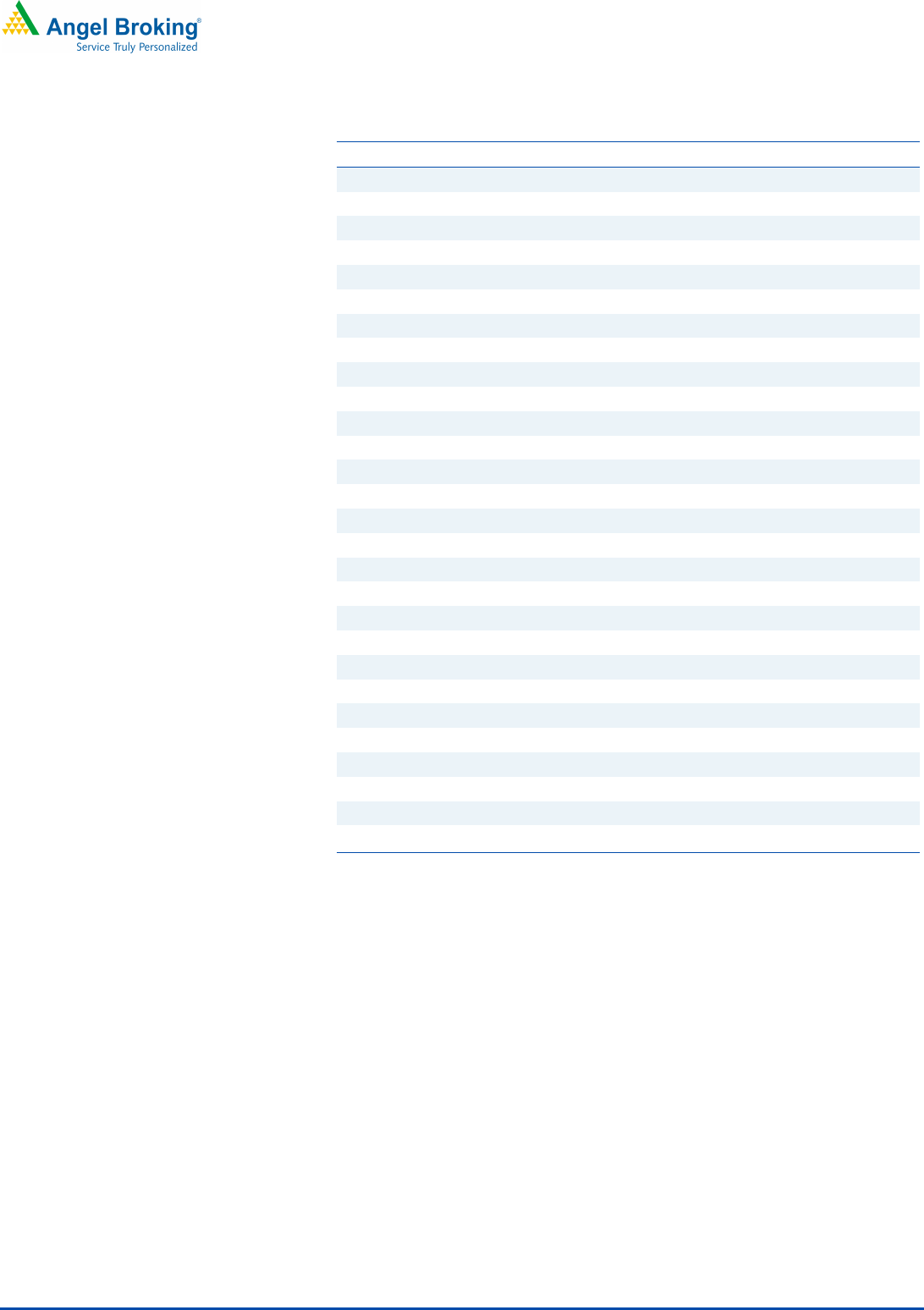

Exhibit 4: Balance Sheet

Y/E March (` cr) FY2015

FY2016

FY2017 1HFY18

SOURCES OF FUNDS

Equity Share Capital 39

39

39 39

Reserves& Surplus 179

208

254 287

Shareholders Funds

218

247

293

326

Minority Interest -

-

-

Total Loans 63

80

81 80

Deferred Tax Liability 10

13

11 11

Total Liabilities

291

341

385

417

APPLICATION OF FUNDS

Net Block

130

138

130

208

Capital Work-in-Progress 21

2

70 0

Investments 0

0

0

10

Current Assets

237

343

310

357

Sundry Debtors 182

221

217 250

Cash 3

2

47 64

Loans & Advances 30

86

23 28

Other Assets 23

34

24 14

Current liabilities 98

145

126 159

Net Current Assets

139

199

184

198

Deferred Tax Asset

1

2

1

-

Total Assets

291

341

385

417

Source: RHP

Future Supply Chain Solutions Limited | IPO Note

Dec 04, 2017

8

Exhibit 5: Cash Flow Statement

Y/E March (` cr) FY2015 FY2016 FY2017

1HFY18

Profit before tax 37 45 58

49

Depreciation 20 21 19

10

Change in Working Capital (16) (74) 31

(3)

Interest / Dividend (Net) 8 5 (2)

4

Direct taxes paid (5) (13) (13)

(15)

Others 1 1 0

(5)

Cash Flow from Operations 44 (15) 93

40

(Inc.)/ Dec. in Fixed Assets (20) (11) (78)

(25)

(Inc.)/ Dec. in Investments

2

8

14

3

Cash Flow from Investing (18) (3) (64)

(22)

Issue of Equity - - -

-

Inc./(Dec.) in loans (11)

31

29

3

Interest / Dividend (Net) (10) (13) (13)

(4)

Others (5)

0

0

0

Cash Flow from Financing (26)

17

17

(1)

Inc./(Dec.) in Cash (0) (1)

45

17

Opening Cash balances

2

2

1

47

Closing Cash balances

2

1

47

64

Source: Company, Angel Research

Future Supply Chain Solutions Limited | IPO Note

Dec 04, 2017

9

Exhibit 6: Key Ratios

Y/E March FY2015

FY2016 FY2017

Valuation Ratio (x)

P/E (on FDEPS)

107.2

90.4

58.1

P/CEPS

60.2

53.1

41.0

P/BV

1.2

1.1

0.9

EV/Sales

0.8

0.7

0.5

EV/EBITDA

5.1

4.9

4.0

EV / Total Assets

1.1

1.0

0.8

Per Share Data (Rs)

EPS (Basic)

6.2

7.3

11.4

EPS (fully diluted)

6.2

7.3

11.4

Cash EPS

11.0

12.5

16.2

DPS

0.0

0.0

0.0

Book Value

543.7

617.2

731.0

Returns (%)

ROCE

15.7

15.0

14.8

Angel ROIC (Pre-tax)

15.9

15.1

16.9

ROE

11.4

11.9

15.6

Turnover ratios (x)

Asset Turnover (Gross Block)

2.7

3.3

3.3

Receivables (days)

163

155

141

Payables (days)

73

76

64

Working capital cycle (ex-cash) (days)

90

79

77

Source: Company, Angel Research

Future Supply Chain Solutions Limited | IPO Note

Dec 04, 2017

10

Research Team Tel: 022

-

39357800 E

-

mail: research@angelbroking.

com Website:

www.angelbroking.com

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.